End-of-financial-year preparation for early childhood education and care providers

As the financial year comes to a close, it’s not just businesses in general that feel the pressure—it’s also a critical time for early childhood education and care (ECEC) providers. As with any business, ECEC services have their own EOFY reporting requirements that can significantly impact their financial health.

The period leading up to the end of the financial year is a time that requires meticulous preparation of comprehensive financial requirements and a thorough assessment of your finances. You need to wrap up your ECEC business’ books, complete tax-time paperwork and all necessary accounting tasks. The reports and summaries of expenses and income for the financial year are crucial, as the Australian Taxation Office (ATO) uses them to calculate your service’s tax obligations.

To lend a helping hand this tax season, we’ve prepared a handy guide explicitly tailored for ECEC providers, ensuring a smoother journey towards a successful closing of the financial year.

While reviewing your EOFY reporting, if you notice you’re struggling with debt management, we can help with that, too. Please check out this handy guide on debt management that you don’t want to miss.

Wrapping up the financial year—EOFY reporting

Most businesses must lodge their tax returns at the end of the financial year. Your business needs to submit a summary of your income and expenses for the financial year. Below is a rundown of the tasks you need to accomplish during this significant period:

Organise and gather all documents

To get started, you must gather all necessary records and documents. Lodging your tax returns requires you to review and reconcile your accounts, which means that you need a profit and loss statement, balance sheet, cash flow statement and the previous year’s tax return.

You’ll need invoices, bills, payments, Business Activity Statements (BAS), bank statements, payments to employees and Pay-As-You-Go (PAYG) withholding obligations.

Lodge your tax return

You can lodge your tax return yourself, but you also have the option of hiring an accountant or tax advisor to assist you in managing your tax obligations. When you choose to employ an accountant or tax agent, verify their registration with the Tax Practitioners Board (TPB). Make sure they’re legit before entrusting your finances to them.

Identify tax-deductible expenses

As a business owner, you may be entitled to tax deductions. As long as the expenses directly affect your income, you can claim them as a deduction. When the end of the financial year arrives, ensure you’ve prepared a list of your business’s tax-deductible expenses. Vehicle, travel, rent, phone or communication expenses are examples of expenditures you can log.

Your list can also include capital asset depreciation, standard deductions, prepaid expenses (like rent or insurance) and charitable donations or contributions. Ensure you keep records proving the legitimacy of your listed business deductions.

Keep your calendar up to date

Mark important financial year dates and cut-offs under the Australian tax year calendar.

Some of the key deadlines to remember for small businesses:

- 30 June—End of the financial year

- 28 July—Quarter 4 Business Activity Statements deadline

- 31 October—Tax return is due

Assess performance and review plans

Review your records and reports to evaluate your performance and determine if you can meet your financial and revenue targets. Once you’ve reviewed your bookkeeping with your accounting, assess strategies that have worked for your business and analyse opportunities for improvement for the next financial year.

The end of the financial year is the perfect time to reflect on your goals and priorities for the year ahead. Look at the viability of your business strategy, the changes in your business environment and potential opportunities here and now.

Review insurance and business structure

Consider whether your circumstances have changed since the previous financial year. Should that be the case, you may need to adjust your insurance coverage.

Consider how your business has grown and whether you need to change your business structure to accommodate it. Your overall business structure may affect compliance and tax requirements.

EOFY reporting webinar

Check out this recording of the 2024 EOFY reporting in Office webinar for a guided walkthrough on completing EOFY tasks in Office, including submitting sessions, checking CWAs, entitlement changes, fee changes, Starting Blocks and dispensations.

Download this easy-reference EOFY in Office Checklist to help you wrap up the financial year quickly and efficiently.

Manage your EOFY reporting with ease

EOFY reporting is something you only have to complete once a year. Trying to remember which reports you need and where you can find them can be overwhelming.

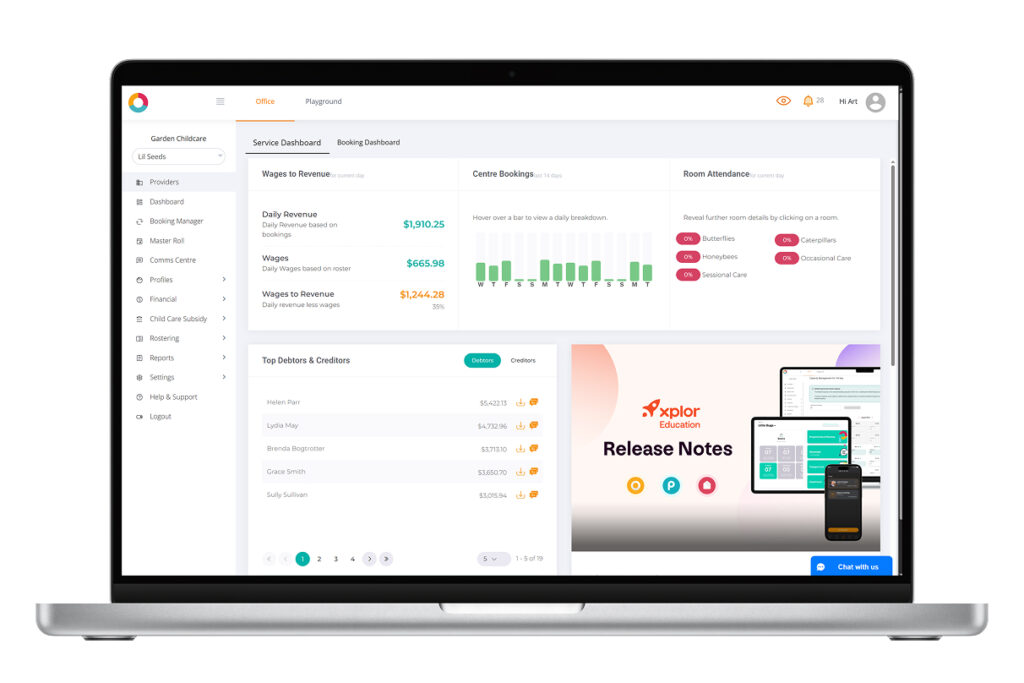

Staying on top of your end-of-financial-year duties can be easier with the help of reliable childcare management software like Office. Below is a summary of the reports in Office you’ll likely need to help with your EOFY reporting, along with brief summaries of each report and where to find them.

Xplor Education aims to simplify the process of accomplishing end-of-financial-year duties. The convenient reporting and functionality allow you to keep your service’s records up to date. Provided your ECEC service ensures it’s always up to speed with reports and submissions throughout the year, come EOFY, things should run smoothly with the help of Xplor Education’s software.

Handy reports for Xplor Education services at the end of the financial year

CCS Notifications Report

With Xplor Education, you can stay up to date on government notifications. These notifications include enrolment confirmation from guardians, end of enrolment and a breach logged by the government. Information is generated up to 90 days before the date you have selected.

To access this CCS notifications report: Reports > CCS Reports > Service Level > CCS Notifications Report

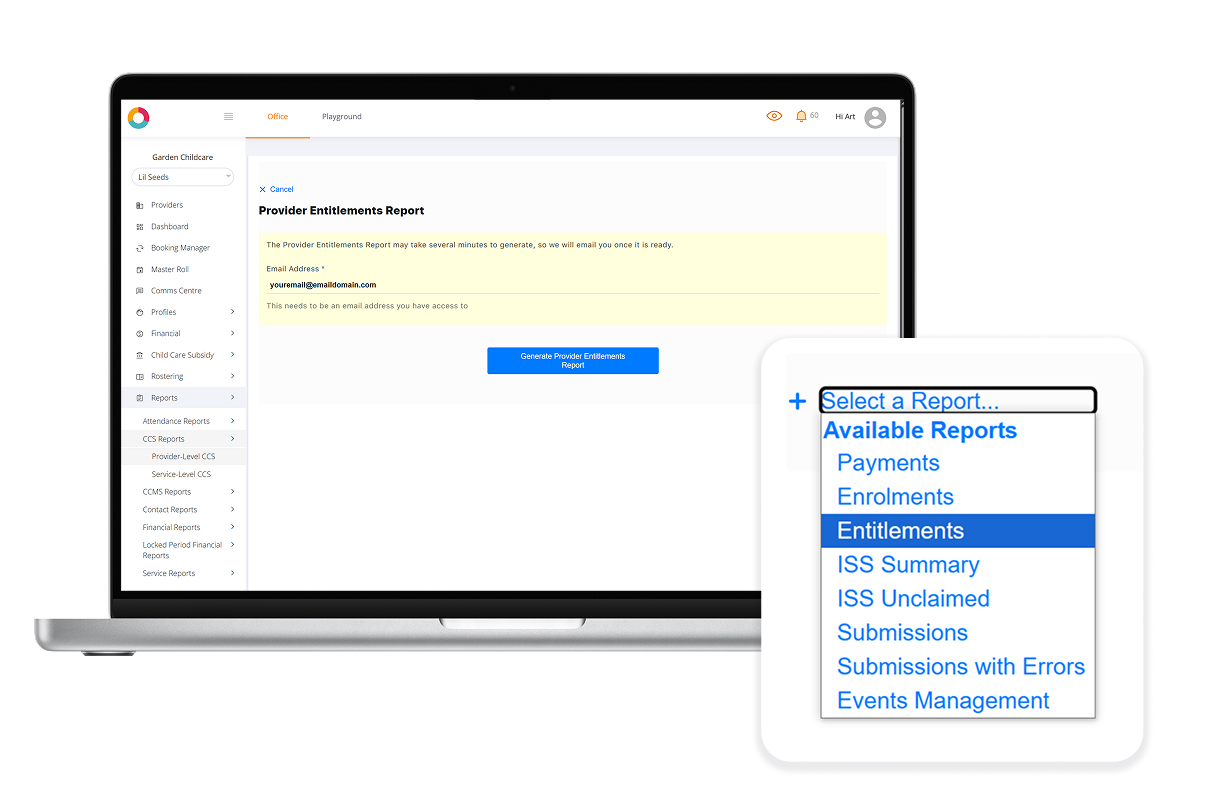

Provider Entitlements Report

Your service can access a summary of parent and guardian entitlements for all children enrolled in your care. Entitlements include hours per fortnight, percentage, ACCS, absence count, withholding percentage and annual cap reached.

The provider entitlements report is in Office: Reports > CCS Reports > Provider Level > Select a Report > Entitlements

These records are essential in identifying if any exemptions apply to families in your care for the financial period. It will help your service determine entitlements properly, which is crucial to ensuring that families clearly understand the fees they have been charged, what those fees are for, and how their Child Care Subsidy has offset those charges.

CCS Weekly Payments Report

The CCS weekly payments report will help your service balance the Child Care Subsidy. It contains a detailed breakdown of how much CCS was paid for each child in a selected week and when it was paid. Remember that the CCS payments per child reports are only generated on a weekly basis in Office.

To find the CCS weekly payments report: Reports > CCS Reports > Service Level > Select a Report > Payments

CCS Entitlement Changes Report

To ensure payment of the correct amount of Child Care Subsidy (CCS), each family must confirm their income each financial year. This is called balancing or reconciliation. Entitlements may change when families update their activity tests and income estimates for the new or previous financial year.

To confirm a family’s entitlement changes over a period of time: Reports > CCS Reports > Service Level CCS > Select a report > CCS Entitlement Changes Report

You can also adjust your family’s payment plan or first Direct Debit after the financial year. Alternatively, you can view changes in CCS Entitlements by using the CCS Entitlement Notifications feature.

Submissions Report

The submissions report in Office summarises the status of CCS submissions for a child. You can choose any date range, and the platform will provide a report showing a single view of CCS bookings (in CSV format).

You can find the submissions report by going to: Reports > CCS Reports > Provider Level > Select a Report > Submissions

It will also give details about whether they’ve been successfully submitted within the provider group for the preceding two weeks.

- If there’s no enrolment attached to an active child, column D will be blank for that child.

- If there are no bookings for an active child, column F will display as “FALSE” (and column G will be empty for that child)

- If there are bookings for an active child in the report, but submissions failed, column F will display as “TRUE”, column G will display as “FALSE” and column H will display the specific submission error.

CCS Weekly Submissions

In Office, to get a summary of the status of CCS submissions for a child: Reports > CCS Reports > Service Level > Submissions

These are generated only on a weekly basis

Transaction Summary Report

This is a locked-period, multi-service CSV report that summarises the following main transaction types from Office:

- Booking Fees

- Child Discounts

- CCS Payments

- Financial Adjustments

- Gap Fee Adjustments

- Balance Adjustments

- Manual Payments

- Auto Payments

To get this report: Reports > Locked Period Financial Reports > Transaction Summary Report > Input Services, Dates, Transaction Types > Generate

You can download this handy cheat sheet of the EOFY reports in Office you’re likely to need, what information they contain and where to find them.

Is it time for a change?

Does your current childcare management software have all the reporting and functionality you need as you wrap up the end of your financial year? Does your platform include built-in tools that help you with debt management? If not, the new financial year is the perfect time to move to a new childcare management platform.

Make a fresh start in the next financial year with an all-in-one platform that will help set your service up for success, backed by one support team for all your needs. Get in touch to discuss your options and learn how Xplor Education saves your ECEC service time by automating administration and improving your debt management.

You might also be interested in…

Blog

Streamline end-of-year ECEC processes to build for success in the new year

The end of the year is a busy time for early childhood education and care (ECEC) services. You have to ….

Read more

Blog

Office—childcare management software that saves you time

Childcare management is a complex task involving numerous administrative responsibilities and coordination between administrators, educators and families. Xplor Education is ….

Read more

Blog

Save time on childcare admin with task automation

Automation is not a job killer Automation may be considered a job killer, but it’s also a life-saver for childcare ….

Read more

by Xplor Education (Marketing Team Lead)

-

First published: 02 June 2025

Written by: Dean Comeau